Client Overview

The client is a Community Health Centre that serves communities through several health locations across Ontario. As a non-profit organisation supported largely by government funding, the centre handles critical services for patients and community members who depend on timely care, coordinated teams, and accurate financial processes.

The finance structure of the client required careful handling due to a small team managing high volumes of operational details. Their previous system, Sage 300, limited their ability to maintain consistent financial accuracy, perform approvals efficiently, and support staff who travelled between health sites. With growing demands across locations, they required an integrated digital environment that could support structured financial operations, dependable governance, and smoother coordination across teams.

What Were the Business Challenges?

The company managed essential services, yet key operational gaps created repeated strain on internal teams who handled financial tasks. Their processes depended heavily on manual steps that demanded time from a very small group of staff members who already balanced several responsibilities. This created issues across invoice handling, expense submissions, approvals, and document processing.

Key challenges included:

Disconnected Expense Handling

Employees and volunteers submitted expenses using spreadsheets, which created significant room for inaccuracies and delayed approvals across departments.

Minimal Automation Across Finance

Essential financial processes required manual updates within Sage 300, including vendor invoices and key entries, which increased workload for the limited finance team.

Limited Integration with Microsoft 365

The client already worked within a Microsoft 365 environment, yet Sage 300 did not support connected workflows, which reduced efficiency across functions.

Insufficient Visibility Across Core Modules

Activities involving finance, purchasing, sales, and fixed assets lacked centralised tracking, which slowed decision making and required repeated coordination efforts.

Resource Constraints

The finance department comprised only two to three members who managed several tasks without sufficient system support, which affected the organisation’s ability to prioritise budgeting and strategic planning.

Business Demands

The organisation required a modern, cohesive system that allowed staff to operate confidently without repetitive steps that consumed time. They needed a reliable financial platform that supported digital document management, accurate expense submissions, and better visibility across operational areas.

Their major requirements included:

- Integrated Financial Information: Centralised financial data improved consistency across departments and centres, supporting reliable coordination and higher operational accuracy.

- Automated Expense Management: Digital expense processing replaced spreadsheets and manual approvals, providing smoother submissions and faster reimbursements for staff across locations.

- Vendor Invoice Automation: Automated vendor invoice handling reduced repetitive work for finance teams and enabled timely, accurate processing across all centres.

- Microsoft 365 Alignment: Connection with Microsoft 365 supported seamless communication, document sharing, and coordinated financial activities across the organisation.

- Unified Operational Platform: A single platform covered finance, purchasing, sales, and fixed assets, delivering structured visibility across critical operational functions.

- Structured Workflow Environment: Guided workflows strengthened compliance and governance by standardising approvals and improving control across financial activities.

- Scalable System Architecture: A scalable system supported expanding operational needs and ensured smooth coordination for additional centres or future service growth.

Objectives

The main objective centred on shifting from heavy manual work toward a digital system that empowered staff with dependable tools, structured workflows, and integrated processes. The goal focused on enabling accurate financial management, efficient document handling, and simplified operations across the organisation.

Cohesive Financial Platform: Create a unified financial system that supports consistent operations across departments and strengthens coordinated activities across locations.

Dependable Workflow Automation: Introduce reliable automation across major workflows to reduce repetitive tasks and support smoother financial operations for teams.

Enhanced Financial Visibility: Improve clarity into expenses, vendor activities, and core financial data to support informed decisions across the organisation.

Microsoft 365 Collaboration Support: Align with Microsoft 365 to strengthen collaboration, document sharing, and communication across all health centres consistently.

Accuracy Focused Team Tools: Equip teams with structured tools that support higher accuracy and minimise reliance on spreadsheets for daily tasks.

Scalable Operational Structure: Build a scalable structure that supports future organisational plans and accommodates expanded services or additional operational needs.

Solution Implemented

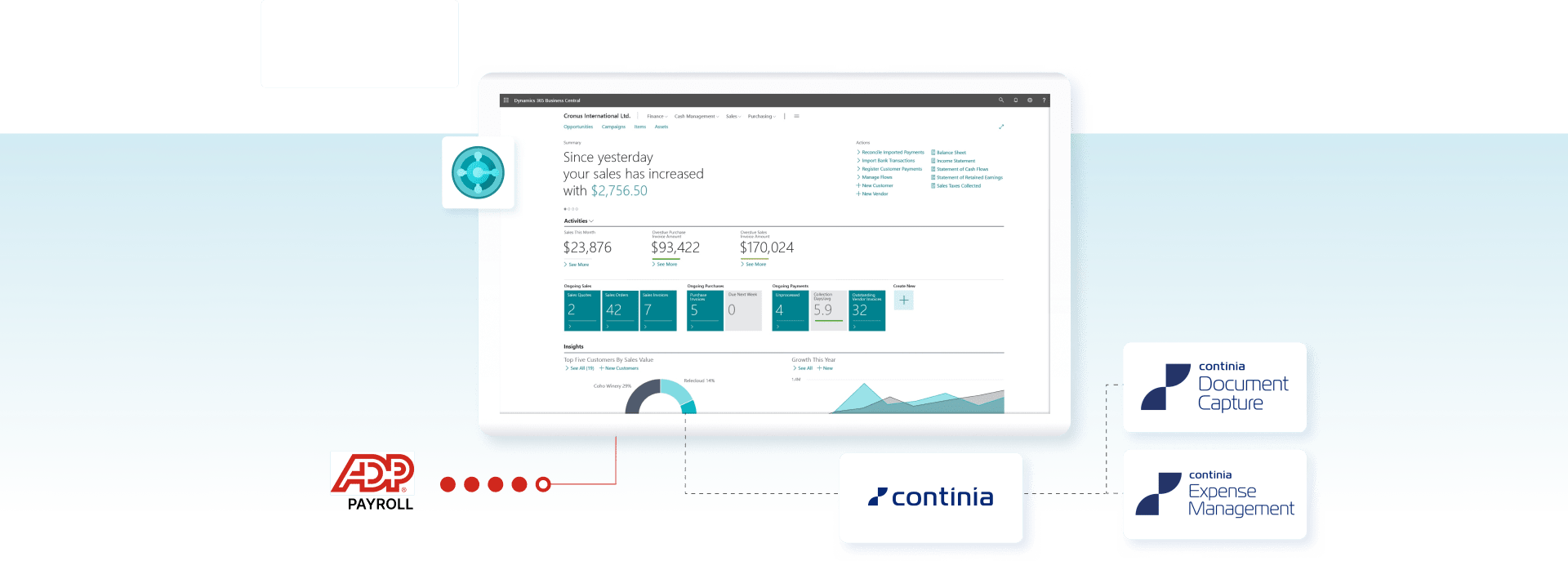

Dynamics Square implemented Business Central with key modules that supported finance, purchasing, sales, and fixed assets. The solution aligned with the organisation’s Microsoft 365 environment, creating smoother communication and connected data across teams.

To support major pain areas, the project also included Continia Document Capture for vendor invoice automation and Continia Expense Management for streamlined employee reimbursements. Additionally, integration with the ADP payroll system supported a connected financial workflow.

Key components of the solution include:

- Unified Business Central Modules: Business Central modules for finance, purchasing, sales, and fixed assets created unified operations and supported consistent financial management.

- Automated Vendor Invoice Capture: Continia Document Capture automated vendor invoice entry and reduced manual handling, improving accuracy and overall processing efficiency.

- Digital Expense Processing: Continia Expense Management replaced spreadsheet-based submissions with structured digital workflows that improved clarity and reduced delays.

- Microsoft 365 Integration Support: Integration with Microsoft 365 enabled connected workflows and reliable document sharing across departments and multiple health locations.

- ADP Payroll System Alignment: ADP payroll integration aligned payroll data with financial processes, supporting dependable record management across organisational functions.

- Structured Approval Processes: Automated approval structures for expenses and invoices reduced processing time and improved consistency in financial decision making.

- Standardised Financial Records: Standardised records across all modules supported consistent reporting and improved accuracy for reviews and strategic planning activities.

- Centralised Digital Operations: A centralised digital environment strengthened coordination across locations and supported reliable communication for key financial activities.

Benefits of Implementation

The implementation helped the client shift from labour intensive processes to a dependable financial system that supported accuracy and team productivity.

Greater Operational Efficiency:

The finance team gained significant relief from manual data entry due to consistent automation applied across invoices and expenses.

Stronger Visibility Across Finance:

Teams now access centralised information across modules, which supports better coordination and more timely financial review.

Streamlined Expense Submissions:

Employees submit expenses digitally through a structured process that reduces delays and improves clarity in reimbursements.

Better Use of Team Capacity:

The finance team now dedicates time to budgeting and essential planning, as repetitive tasks have reduced substantially.

A System Ready for Growth:

The solution supports multi-centre operations and is structured to accommodate future expansion in services and locations.

Case Highlight: Strengthening Financial Operations for a Nonprofit Health Provider

Before the project, the company’s finance team worked through heavy manual workloads involving spreadsheets, scattered submissions, and time-consuming entries.

After implementation, the organisation operates with a connected financial platform that supports accuracy, clarity, and dependable automation across major tasks.

Seamless Expense Processing:

Staff handle expense submissions through a guided digital workflow that supports timely approvals.

Consistent Vendor Management:

Vendor invoices flow through automated capture and approval paths that support accuracy and reduced effort.

Unified Financial Records:

Core modules now share consistent information, which strengthens financial reporting and daily operations.

Significant Time Savings:

The finance team now manages high-value responsibilities with greater confidence due to reduced manual effort.

Through structured automation and alignment with Microsoft Business Central, the client now runs efficient financial operations that support staff, volunteers, and community service commitments.